cap-and-trade versus carbon taxes which market mechanism gets the most attention

For firm A the 3 tax is less than the 4 cost to reduce so A pays the tax and does not reduce. As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases.

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

The cap gets stricter over time.

. A key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of attractions over pure cap and trade. Carbon Tax vs. Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate.

One interesting result from this research is that cap-and-trade wins hands down over carbon taxesit received more and more positive media attention in the US in the 22-year time period. A Carbon Tax Government sets a tax of 3 per ton of emissions. Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario.

We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price. April 9 2007 413 pm ET. It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas.

Cap and trade allows the market to determine a price on carbon and that price drives investment decisions and spurs market innovation. A carbon tax is one way to put a price on emissions. Its generally agreed among economists that the solution for climate change is either a carbon tax or a cap and trade permit system.

A carbon tax is an explicit tax and Americans are notoriously tax phobic. It provides more certainty about the amount of emissions reductions that will result and little certainty about the price of. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is.

This does of course assume that you. A carbon tax sets the price of carbon dioxide. This was partly due to lower production volume overall but the.

The proposal starts the fee at 15 per metric ton of CO2 equivalent and increases the cost by 10 each year. In contrast cap and trade levies an implicit tax on carbon. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways.

Cap-and-trade has one key environmental advantage over a carbon tax. Taxes provide automatic temporal flexibility which needs to be built into a cap-and-trade system through provision for banking borrowing and possibly a cost-containment. Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and.

Implementing a carbon fee where the revenue is returned to the American people is. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Cap and trade differs from a tax in that it provides a.

Each approach has its vocal supporters. A carbon tax and cap-and-trade are opposite sides of the same coin. In contrast under a pure cap-and-trade system the price of carbon or CO 2.

Although cap-and-trade is the most cost-efficient option for firms more revenue from a carbon tax system can be used by the government to fund spending or reduce other. Peter MacdiarmidGetty Images G r a n t h a m R e. The trade part is a market for companies to buy and sell allowances that let them emit only a certain amount as supply and demand set the price.

The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or. This can be implemented either through. Carbon emissions trading known as cap and trade works by imposing a restriction on the amount of emissions that power companies oil refineries and other energy.

Several analyses have claimed that a carbon tax is superior to cap and trade in terms of the ability to achieve a fair distribution of the policy burden between polluters firms and consumers to. Some voters seem to think that policies like cap and trade which apply directly to producers have less impact on the prices they face than carbon taxes where the impact can. Up to 10 cash back In conclusion in the debate between cap-and-trade or carbon taxes as a market-based solution to climate change cap-and-trade wins hands down in the mediait received more and more positive attention in the national US newspapers in the time period under study than carbon taxes.

Are Carbon Markets For Farmers Worth The Hype Civil Eats

Cap And Trade An Overview Sciencedirect Topics

Chapter 1 What Is The Best Policy Instrument For Reducing Co2 Emissions In Fiscal Policy To Mitigate Climate Change

Regional Carbon Pricing Initiatives Climate Xchange

Federal Climate Policy 103 The Power Sector

Both Parties Used To Love The Carbon Tax So Why Are They Giving Up On It Grist

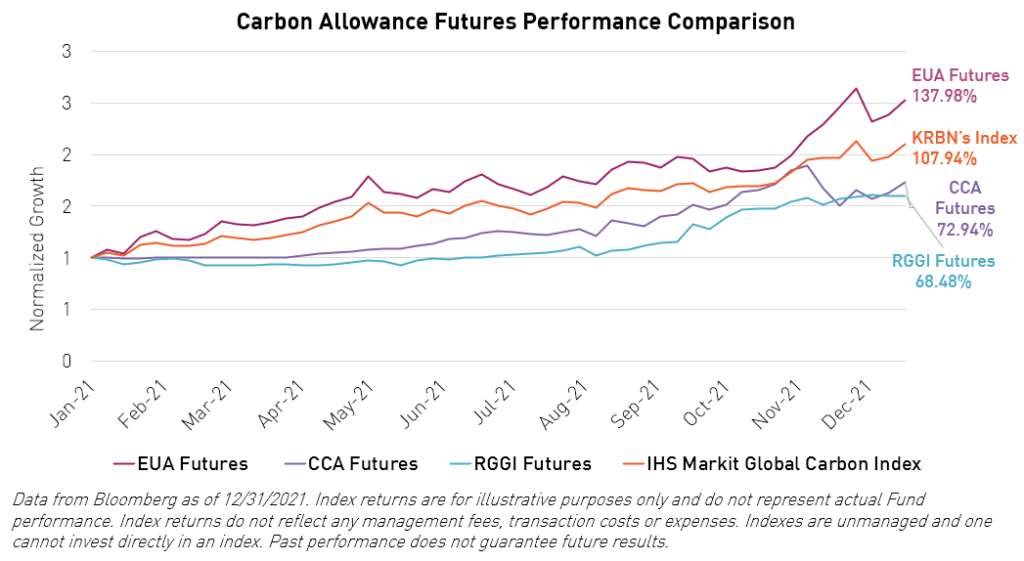

Carbon Markets Everything You Need To Know As 2022 Takes Off Kraneshares

Environmental Economics Permit Markets Britannica

Where Carbon Is Taxed Some Individual Countries

Can Voluntary Carbon Markets Change The Game For Climate Change Raboresearch

In Depth Q A Will China S Emissions Trading Scheme Help Tackle Climate Change Carbon Brief

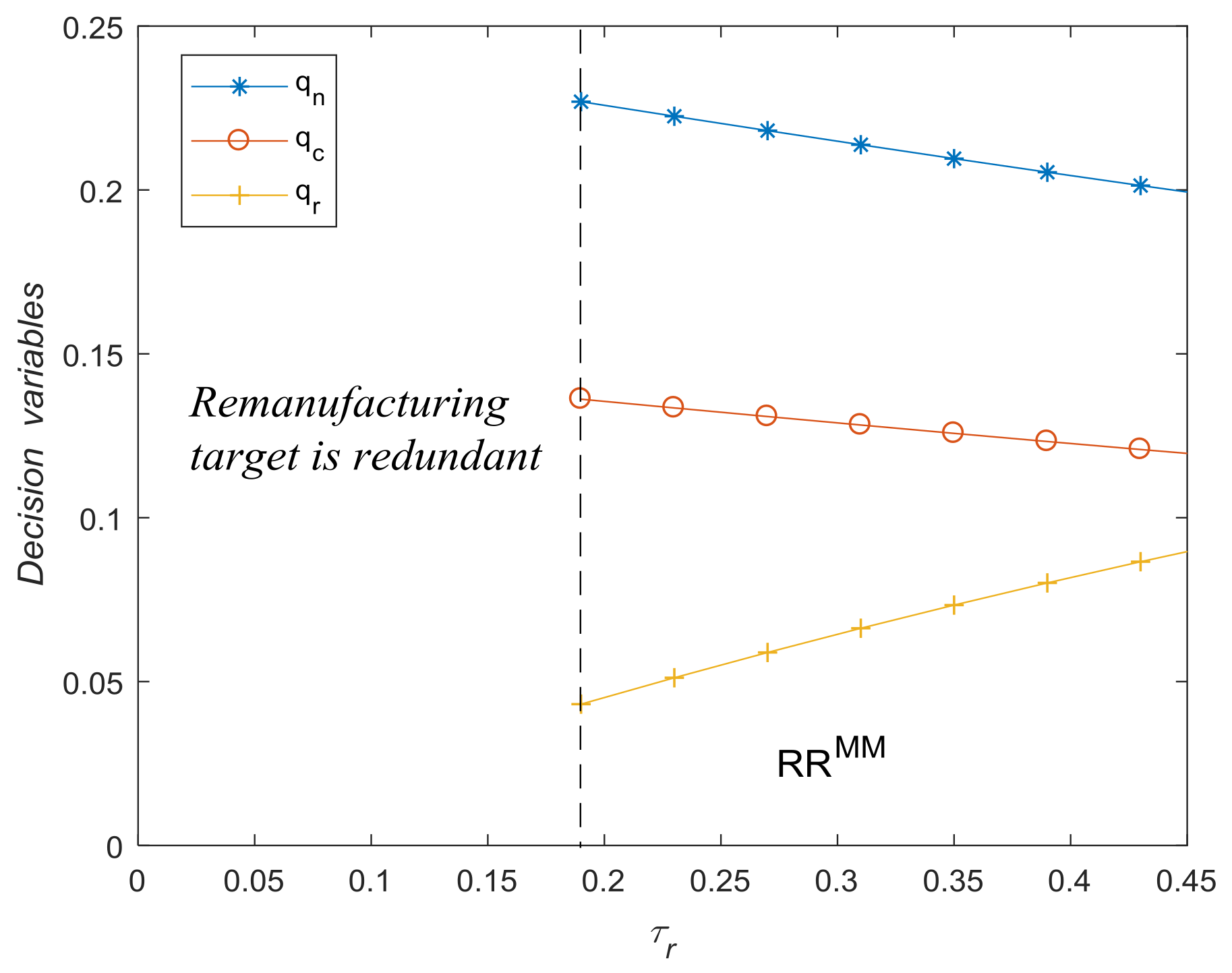

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

Energies Free Full Text Carbon Taxes And Carbon Right Costs Analysis For The Tire Industry Html

Regional Carbon Pricing Initiatives Climate Xchange

Chapter 4 The Social Cost Of Carbon Valuing Carbon Reductions In Policy Analysis In Fiscal Policy To Mitigate Climate Change

Ijerph Free Full Text Decision Making And Environmental Implications Under Cap And Trade And Take Back Regulations Html

Germany S Greenhouse Gas Emissions And Energy Transition Targets Clean Energy Wire